Which of the Following Is A Variable Expense? A variable expense is anything that varies from month to month. For example, a variable cost could be your office space, rent, or utilities. You’re in charge of the monthly budget for your company, and one of the areas you need to watch is the variable expenses.

In this blog post, we’ll walk through the different types of variable expenses and explain why they are important to keep track of when planning your monthly budget.

From time to time, you may find yourself in the middle of a difficult situation. That’s okay! We’re here to help. In this blog post, we’ll walk through some of the most common questions we receive about working from home and how to avoid them.

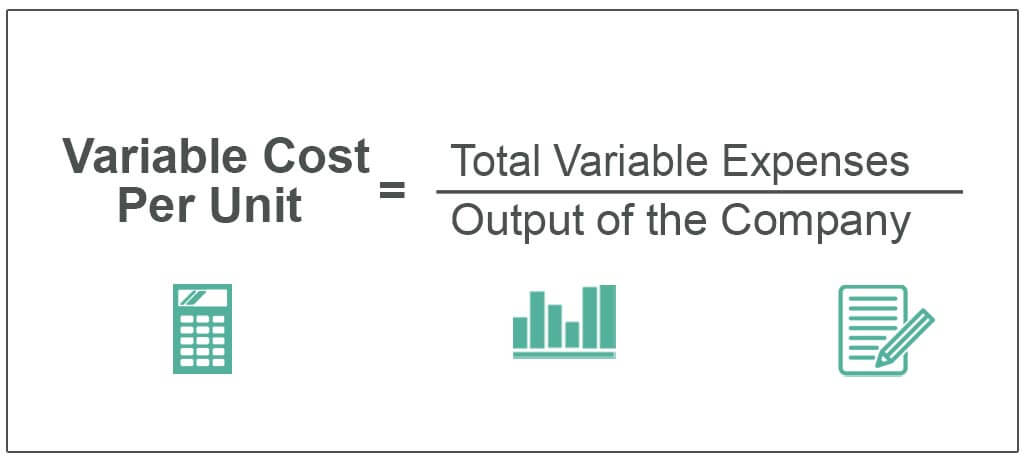

What is a variable expense, and how do you calculate it? This post covers the variables in calculating variable costs and how to calculate them.

The IRS allows businesses to deduct certain business expenses against their taxes. However, not all business expenses qualify for deductions. Here is a list of common business expenses that can be deducted from your income taxes.

Variable expenses

The most common variable expenses include:

• Rent or mortgage

• Utilities

• Taxes

• Insurance

• Advertising

• Business lunches

• Business entertainment

• Business meals

• Child care

• Child care transportation

• Health insurance premiums

• Travel (airfare, hotels, and car rentals)

The next time you find yourself trying to figure out which expenses are variable and which are not, this list will help you understand which are irregular and which are just fixed.

Fixed expenses

Most people think that all of the following expenses are variable expenses. But they’re not.

A) Rent

B) Phone bill

D) Gasoline

The first two are fixed expenses, while the others are variable. And yes, even car insurance is a variable expense.

Variable expenses are those that increase and decrease with your income. For example, you can see that the gasoline expense is unstable because the price of gas increases with the cost of living.

Capital expenses

The variable expenses I’m talking about are the ones that change based on how many sales you make. Some examples would include the website, hosting, and advertising costs.

However, when you’re starting, you may not have enough sales to justify investing in these services. So, you may have to pay a lot for your first few months until you see if you can get things going.

Of course, as you start to make money, your expenses will decrease, and you won’t have to worry about them anymore.

There are several different types of capital expenses that you might incur. They can vary depending on what kind of business you are operating.

The two main categories of capital expenses are fixed and variable. A variable fee is one where the cost varies with the volume of business. Fixed prices are generally set regardless of volume.

Advertising

One of the key concepts to understand when advertising is that it’s not a fixed cost. It is variable because of the many factors that go into it.

The variables include:

What you’re advertising

Who you’re promoting to

Where you’re advertising

When you’re advertising

Variable cost is an expense that varies depending on the quantity produced.

Fixed costs are the costs that remain the same regardless of the quantity produced.

Variable cost is the sum of the fixed costs and the variable costs.

Fixed costs are the total cost of a product or service that remains the same regardless of the amount produced.

Fixed costs are the total cost of a product or service that remains the same regardless of the amount produced.

Frequently Asked Questions (FAQs)

Q: How can I find out what my variable expenses are each month?

A: You must go back and add all your monthly expenses. Look at what you spent for each item and multiply the amount paid by the number of days in the month. Then add these items together. The sum of this total represents your variable expenses.

Q: How much do my variable expenses cost?

A: Your variable expenses can range from $1,000 to $3,000 or more, depending on the items you purchase.

Q: How can I reduce my variable expenses?

A: Try not to overspend. Don’t buy everything you want at once; try to make purchases with a budget.

Q: Which of the following expenses are variable costs?

A: Rent, taxes, telephone, utilities, insurance, and car payments are all variable expenses.

Q: How many different types of variable expenses are there?

A: There are three different types of variable expenses. Rent, insurance, and telephone are all regular variable expenses. Utilities, taxes, and insurance premiums are all fixed expenses.

Q: Do these expenses vary each month?

A: All three expenses mentioned are fixed for a certain period. For example, rent is set for a year, but your phone bill may vary depending on the time you spend on the phone.

Myths About Variable Expenses

1. It isn’t easy to get your health care covered by your insurance company

2. Your doctor will never approve of you getting your health care covered by

your insurance company

3. If a company pays for an employee’s medical treatment, that employee is not paid.

Conclusion

This question seems straightforward, but it’s knowing the difference between variable and fixed expenses. If you must want to know how much your monthly expenses will be, I recommend checking your bank statements and credit card bills.

If you want to make more money, I suggest looking at how to reduce your monthly expenses.

An important aspect of running a business is the constant need to cover expenses.

For example, a freelance writer can expect to work on a project for a fixed price. However, if you spend more time on the project than expected, your client normally pays for it. This is an expense called a variable cost.

Another example would be when you’re selling on eBay, you may charge a fixed price for your item, but if it sells for more than the original price, you’ll lose out on the difference. This is an expense called a variable profit.

A third example would be when you’re creating a website. Depending on the type of website you’re making, the cost of hiring someone to set it up and the time it takes to make the site may be considered variable expenses.